This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

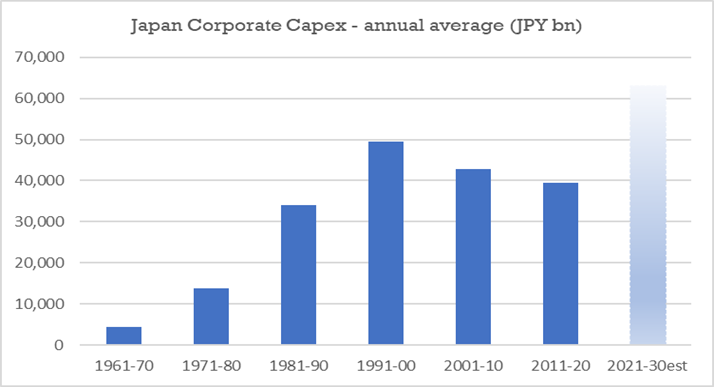

This article follows from our earlier note in Aug-23 on industrial renaissance of Japan. A recent survey by Nikkei News has confirmed that Japanese companies plan to increase capital investment by 15.6% in the current fiscal year ending Mar-2025. This is a second consecutive year of new records, and reinforces our expectations of structural revival in capex by Japanese companies after more than two decades of slump through the 2000s and 2010s (chart below).

Source: MOF Japan, AE Research Management (est)

And while capital investment in the past few years have been centered on semiconductors and EV (electric vehicle) related industries, we believe the renaissance will broaden to heavy engineering sectors. The core competencies such as structural forging and machining, combustion & propulsion engineering, turbo-machineries, high voltage electrical systems as well as microfiltration, are mission critical technologies to enable the global energy transition & decarbonization roadmap.

Japan has traditionally excelled in heavy engineering fields. However, due to the wholesale shift in global electricity generation to renewables from fossil fuels, the nuclear winter post-Fukushima incident and prolonged period of muted defense spending, the heavy industries supply chain have substantially downsized their capacity. Similar consolidation has taken place at Japanese shipyards – effectively all the major yards in Japan are now cooperating rather than competing.

Just as the supply base becomes scarce, the demand for heavy engineering capabilities is reviving, led by energy transition and security requirements which have super longevity ahead – illustrated in the next section. This builds on recurrent aerospace works that Japanese heavy industries players are already locked into via their participation in critical aeroengine parts for Airbus and Boeing aircrafts globally. The new paradigm in Japan defense spending – where national defense budget will double to 2% GDP from 1% GDP (pre-2023), with costing mechanism to ensure profit margins of 15% for defense contractors – will further underwrite long-term business for companies in the heavy engineering supply chain.

Certainty of baseline profitability will not only support the valuation re-rating of listed stocks in the energy transition, aerospace and defense fields, but spur fresh capacity investments down the road.

Energy Transition & Security – Towards a More Balanced Approach

Global energy transition dynamics are at an early stage of a supercycle that will extend beyond 2030. While the earlier focus has been disproportionately on renewables, the reality of market forces plus evolving political landscape have prompted a shift back to a more realistic and balanced approach in the global decarbonization roadmap.

Nuclear revival

At the recent COP28 (Conference of the Parties to the UN Framework Convention on Climate Change), 22 countries encompassing the key OECD states have signed a declaration to triple their existing nuclear power generation capacity by 2050 to help the world achieve the net zero target.

The OECD currently have 263 GW of nuclear capacity (equal to 67% of total global capacity). As their capacity are extremely aged, some 90% of existing plants will reach end-of-life before 2050.

To triple the existing nuclear capacity, new builds amounting to 773 GW will be necessary. Given the long lead time for construction and commissioning, orders for primary equipment such as reactor pressure vessels must be made between now and 2043 or about 41 GW per year. This translates to orders for 27 reactor pressure vessels per year (each reactor rated at 1500 MW) from the OECD nations alone. There would be enormous capacity challenges to meet such demand, since the nuclear supply chain has diminished after prolonged downsizing post the Fukushima incident in 2011.

Hokkaido-based Japan Steel Works (JSW) is one of the few remaining ultra-heavy forging facilities with nuclear accreditation that could be the supplier of choice of reactor vessels for new nuclear plants in the OECD. The company can supply other heavy nuclear parts as well, such as pressurizers, steam generators and turbine rotor shafts. During pre-Fukushima period, JSW boasted 80% of global share in ultra-heavy nuclear forging, using its 15,000-ton presses capable of handling ingot size of 600-700 tons. Even if assuming lower market share of 50% in the future, the company will be in line for orders of 14 reactor vessels set each year, a quantum rise from current rate of less than 4. The figures above are meant to illustrate the scale and longevity of the nuclear renaissance ahead, not precise forecasts as such.

Decarbonisation of thermal power plants

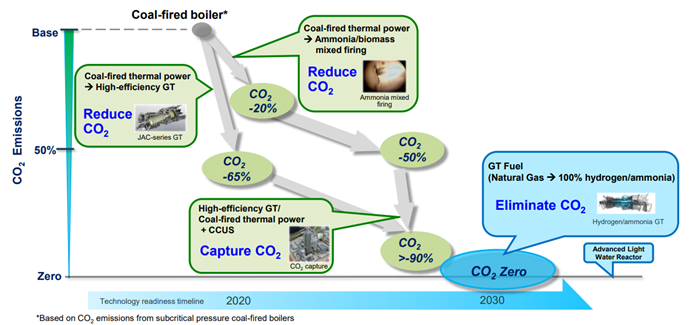

For the case of fossil-fuel, there has been recognition that gas-fired power plant is the practical replacement of coal-fired plant to substantially reduce the carbon footprint of baseload electricity. Gas turbine combined-cycle (GTCC) technologies has improved to the point that it could reduce the CO2 emission by 65+% compared to a coal-fired plant. And the more advanced GTCC turbines are compatible with co-firing of ammonia/hydrogen (zero carbon energy source) once such technology is ready in the 2030s. Together with carbon capture and storage (CCUS), thermal power plants can eventually reduce CO2 emissions by over 90% (graphics below),

Source: MHI (Apr 2023)

Mitsubishi Heavy Industries (MHI) is the leader with 36% global market share, and 56% share in the advanced class turbines. A simple calculation of replacing all the existing 2100 GW of coal power plants globally with GTCCs by 2050 (at cost of USD 1000 per kW), would generate orders worth USD 84bn of gas turbines annually. With a market share of 56%, this would mean potential revenue of USD 42bn per annum for MHI, equivalent to 9x its current gas power plant business. Also noteworthy is that core heavy components of MHI turbine systems are fabricated by JSW.

There is real possibility not all coal power plants will be phased out by 2050 (although G7 countries has announced their intention to phase out unabated coal power by 2035). But the dynamics do suggest exponential rise in business for a heavy engineering sector that has undergone massive consolidation in the past 10 years. Like the nuclear supply chain, there will be severe capacity limitation resulting in strong pricing power for mission-critical players.

Connecting the renewables

Investment in renewables has reached an inflection point, seen in the extreme fluctuations in intraday energy prices in EU countries, including many episodes of negative power prices. This indicates there are now excess wind and solar installations, but the transmission grid has not been upgraded to enable inter-regional transfer of surplus electricity.

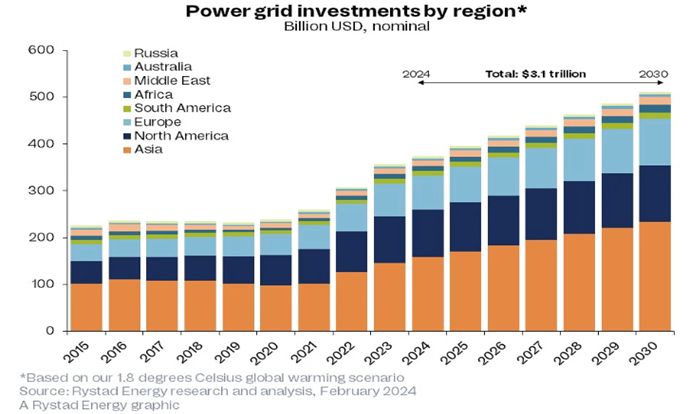

Source: Rystad Energy

Utilities around the world have been scrambling to invest in power grid since 2022/23 after prolonged stagnation (chart above). The IEA (International Energy Agency) estimated that the world will need to add and replace a total of 80 mio km of power transmission & distribution lines (the equivalent of existing network) by 2040. Grid investment spending is forecasted to more than doubled to USD 600bn per annum by 2030, not only to replace ageing power lines and equipment such as transformers and rectifiers, but also to introduce DC (direct current) technologies.

HVDC (high voltage direct current) transmission system is more compatible with digitalization, decarbonization and distributed generation architecture. The advantages include a cheaper mode of bulk electricity transmission over longer distances, a more stable network that is resilient to cascading blackouts, as well as facilitate intelligent control of the grid. A technological leader in DC transmission power cables system is Sumitomo Electric Industries – insulating technologies that allow conductors to operate at temperature 20 deg C higher than normal (thereby requiring less copper), as well as with flexible polarity reversal features.