This article reflects the opinion and analysis as well as information collated by AE Research Management Sdn Bhd, and does not constitute an investment advice or recommendation

Our investment philosophy is focused on companies with deep science and engineering foundation, which play pivotal role in driving the productivity megatrends that improve our quality of life. Within each trend, there are evolving dynamics which pose incremental challenges and opportunities. In this article, we illustrate on more recent developments in energy security, semiconductor technological roadmap and in pharmaceutical R&D.

Energy Security – Reassessment

Fossil fuels – gas, oil, and coal— accounted for more than 80% of the world’s energy consumption in 2021, and hydrocarbons still contributed to more than 50% of the electricity generation.

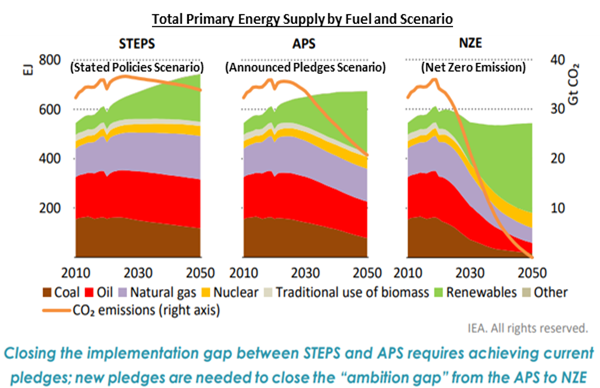

A study by the IEA (refer to charts below) in 2021 shows that the world will still fall short of achieving net zero emissions (NZE) by 2050 even if all pledges and promises are fulfilled (APS scenario). While if only existing or under development policies are maintained, fossil fuel consumption will drop only modestly by the end of 2050 (STEPS scenario). And these are projection made priors to the Russia-Ukraine war.

The geopolitical crisis that erupted in early 2022 has prompted nations to re-assess their approach to long-term energy security. Energy shortage is critical in regions such as Europe which has banned seaborne oil and gas from Russia, and Asia where household consumption is disrupted by high energy prices. Policy makers have no choice but to make a U-turn on their energy policy to address the imminent energy crisis. And coal has become the savior due to its cheaper and plentiful nature.

Even under the original APS scenario, natural gas and coal will remain omnipresent as energy sources through 2050. Now, the APS scenario could be pushed out further and the path to NZE takes much longer than before.

Hence, the world will remain dependent on the engineering capabilities of a handful of makers of specialized pumps that operate at extreme pressure/temperatures, such as boiler circulating pumps inside thermal power plants, and cryogenic pump for LNG infrastructure.

Such companies, although being associated with hydrocarbon industries, also contribute to lowering of carbon footprints with their technologies. For example, given that 90% of the cost throughout the lifetime of pumps and motors is in energy consumption, the world’s leading boiler circulation pump maker has designed pump structures that minimize energy loss during fluid transfer thereby reducing energy consumption by more than 15%. Similarly, cryogenic technologies are mission-critical to transportation of hydrogen, the truly green source of energy of the future.

Semiconductor – node advancement difficulties

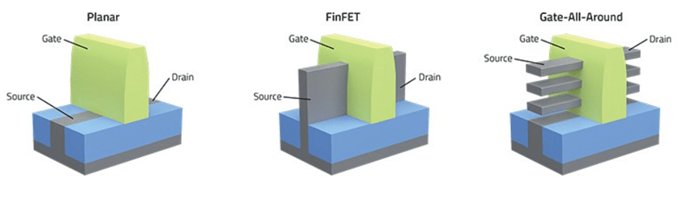

During 2022, the industry launched the next generation logic processors which are fabricated at node separation of mere 3nm, used in the latest iPhone 14. With node size this small, there are risks that the established FinFet gate architecture which has been used since circa 2011 (on nodes of 20nm) could face performance issues.

One of the major logic foundries has chosen to switch to the new GAA (gate all-around) architecture, but another has stayed with the FinFet architecture for its 3nm chips. Nonetheless, it is certain that all logic producers will eventually adopt GAA for their most advanced node. As GAA is a complex architecture (see graphic below) which is inherently much more difficult to fabricate, there is a risk that yields will fail to reach optimal level even at mass production.

Another major physical hurdle ahead for logic node shrink could be what is termed the quantum tunneling effect. This is the phenomena when the separation between regions in a transistor (eg. between gate and channel) becomes too small, electrons can jump across separation barriers. Transistors will therefore no longer able to exhibit the logic state of binary 0 or 1 in a controllable manner. Quantum tunneling could mark the biggest challenge yet to logic node scaling.

For sure, the industry will continue to pour massive R&D resources to overcome the limitations via novel materials and gate designs. Nonetheless, the risk is that the technological roadmap will plateau at nodes of 2-3nm, as the cost versus benefits (faster processing speed, lower energy consumption) of further scaling are no longer compelling.

Several implications will arise:

- instead of pursuing node shrinking, semiconductor makers will seek to improve their chip performance via packaging technologies, in particular the multi-die concept (where a large monolithic system-on-chip is broken down into separate functional dies that are fabricated separately, before being bonded together);

- as the industry stagnates at the same advanced nodes for much longer than before, it allows China (which has been restrained by US from accessing the sub-14nm technologies) time to catch up through its own ecosystem development;

- simultaneously, China semiconductor players will also actively pursue advanced packaging/back-end technologies such as the multi-die architecture.

Adoption of multi-die architecture will bolster the outlook for suppliers of semiconductor wafer dicing and grinding equipment. On the other hand, there is a risk of slower uptake of next-generation process materials and equipment cater specifically to sub 3nm process, such as metal-oxide resists and EUV steppers.

Pharmaceutical – renewed attention on neuroscience

In 2022, much attention has been on Alzheimer’s disease since the FDA approval of a new but controversial drug, Aduhelm, after nearly 20 years of wait. During the year, two other contenders announced seemingly positive data, with both expecting an accelerated approval in early 2023.

Neurological-related disorders are devastating because not only they destroy every aspect of one’s life, but also pose large economic burden to their families. Unfortunately, majority of these disorders still lack treatment. Unlike oncology and immunology which achieved great success in the past decades, neurology has faced a string of failures due to several factors:

- lack of understanding on the brain basics given its inaccessibility;

- unclear disease mechanism and the absence of biological markers; and

- the presence of a natural brain barrier, the blood-brain-barrier (BBB) that blocks foreign molecules from entering.

Today, technological advancement in AI, diagnostic testing, imaging, genomics and the evolution of drug modalities have offered significant potential for reviving the field.

Prior to the 2000s, billions were spent, and decades of research were conducted based on long-standing hypotheses. With the application of sequencing, AI and machine learning, correlated markers can be identified by analysing gene expression patterns within a patient population. The presence of disease markers provides a clearer picture of the underlying mechanism, thus supporting development of therapeutics and diagnostics.

Another major breakthrough in the field was the development of blood-based biomarker tests. Improved mass spectrometry sensitivity has made it possible to measure brain biomarkers that are extremely low in concentration. Diagnostic companies have raced to launch new Alzheimer blood tests as more therapeutic candidates were publicised. As accuracy improves, they could replace expensive imaging scans and invasive lumbar puncture, resulting a paradigm shift in diagnosis.

For decades, little importance were given to diagnosing untreatable brain disorders. Now, the field has changed. Accurate diagnosis has become crucial to patient selection for clinical trials of targeted therapies, which are designed to be effective in certain subset of patients. Similar developments were seen in Parkinson’s disease and Multiple system atrophy (MSA), where imaging agents for disease hallmarks have showed diagnostic potential and are currently in trials. Efforts have also been made to develop more specialised imaging systems. Specialised Head PET scan device with higher sensitivity, higher definition and throughput was launched in 2021 to support clinical research for neurology.

Up until recently, it was almost impossible to treat the brain with large molecular drugs such as enzymes and antibodies due to the presence of BBB protection. In 2021, world’s first brain-penetrating enzyme was launched in Japan. The ground-breaking platform, ‘J-Brain Cargo’ created huge possibilities for new treatments, by conjugating therapeutic agents onto a brain-penetrating vehicle. While the pioneer Japanese company is developing a range of drugs for enzyme-related disorders, other players in the field are working on brain-penetrating therapeutics for Alzheimer’s and Amyotrophic Lateral Sclerosis (ALS).